Malaysian Gov Plans to Amend Employment Law to Support WFH

Create Job Description Using AI

Write appealing job descriptions for any job opening to attract the most qualifield and suitable candidates. FOR FREE.

try now

It appears that the Work From Home (WFH) culture in Malaysia is here to stay, even after the COVID-19 pandemic.

Recently, Prime Minister Tan Sri Muhyiddin Yassin stated that the Human Resources Ministry and Public Service Department would look into developing WFH facilities, with full pay, for people caring for aged and ailing family members, and men with newborn children.

The Human Resources Ministry is also planning to amend the Employment Act 1955 to support WFH. But not everybody likes the idea. Most private-sector employers say no, while those from civil service say yes.

Public sector on WFH arrangement

According to the Public Service Department, civil servants in the public sector have done well with WFH, and it will turn into a long-term policy after the pandemic. The department said that once the MCO was imposed in March 2020, the public sector quickly adapted to the WFH culture.

The department issued a circular to enhance the public service delivery system and strike a balance between completing duties and employee wellbeing.

The department believes that the WFH benefits far outweigh its problems as it has improved employee mental wellbeing and motivation.

The Public Service Department's primary focus is to ensure that civil servants will not misuse the WFH initiative, and its implementation will not hurt the quality of service delivered. The department also said that those who WFH must comply with rules such as staying at home and being reachable during work hours.

Private sector on WFH arrangement

Even though most private sector employers are open to changes, they still want their employees to get back to the office when the COVID-19 pandemic ends.

Malaysian Employers Federation executive director Datuk Shamsuddin Bardan stated that most employers prefer how things were under the "old norm".

He cited a survey in 2020, which stated that most employers said no to keeping WFH arrangements. Only 10% would consider implementing the WFH initiative in the long term.

However, Shamsuddin recognises that there are advantages to WFH arrangements, but the government should iron out the framework properly. He says that the government should consult all stakeholders, including employers and employees, before amending the law to support WFH.

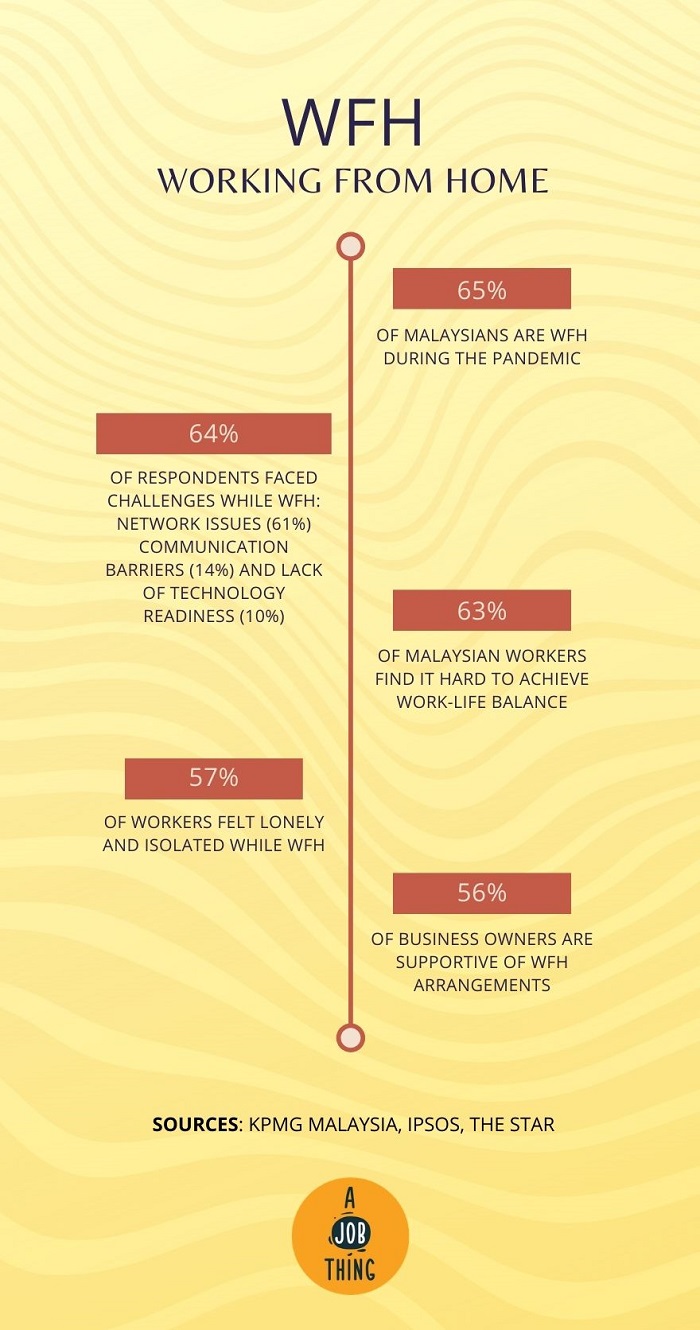

The majority of Malaysians are working from home during the pandemic.

Since employees would require proper work stations and equipment at home, Shamsuddin suggested that the government should provide tax incentives for employees if they pay for such items. He added that if employers contribute, they should receive some tax relief too.

He does not think that WFH is a part of Malaysian culture as of now, but things can change to suit the times.

He said that there are some issues bosses face when it comes to WFH, primarily productivity loss. According to Shamsuddin, many employees faced internet connection issues, which the government and internet service providers should address. Otherwise, employers will not have the confidence to adopt WFH arrangements.

He also questioned whether an employee's health and safety could be taken care of when they work from home. He said that employers need to provide a safe workplace, but it will be a big issue to inspect every employee's home.

Shamsuddin acknowledged that the Social Security Organisation covers work-related accidents at home, but he prefers it to be written in law. He said that the law has to confirm that if an employee works from home, their home is considered a workplace, covered for injuries and other incidents.

Source: The Star

You might be interested in these articles!

You Can Claim These Tax Reliefs for Year of Assessment 2020

HR Guide: Tax Clearance Letter, Form CP22 and Form CP22A

HR Guide: The Basics of Form E