HR Guide: Tax Clearance Letter, Form CP22 and Form CP22A

Create Job Description Using AI

Write appealing job descriptions for any job opening to attract the most qualifield and suitable candidates. FOR FREE.

try now

According to the Income Tax Act 1967, employers have the responsibility of reporting matters to the Inland Revenue Board of Malaysia (IRBM), such as employee retirement, death, departure from Malaysia or cessation of employment.

In 2016, IRBM introduced Operational Guidelines that explain the tax clearance application procedures and responsibilities.

Tax Clearance Letter

The IRBM's Tax Clearance Letter, also known as Surat Penyelesaian Cukai (SPC), is a letter that notifies the employer of a retiring, resigning, or deceased employee's tax liability to allow the employer to make the final payment of salary/gratuity/compensation to the said employee.

When should the employer make an application?

The employer shall make the application when the employee:

- Is leaving the country for more than three months, or

- Is resigning from the current employment, or

- Is retiring, or

- Passes away.

The employer's responsibilities

The employer must notify IRBM and apply for SPC under these circumstances:

- Not later than thirty days before the employee's expected departure/termination date.

- Within thirty days after the death of the employee.

The employer must retain the amount of money due to the employee, such as salary, gratuity or compensation, until 90 days IRBM receives the notification or after they issue the SPC.

After that, the employer is allowed to release the money withheld. Usually, the employer would release it after receiving the SPC.

How employers can apply

- Employers can make the SPC application online via e-SPC on ezHASiL.

- Employers can also make the application manually by submitting a form at an IRBM branch that handles the employee's income tax file.

Form CP21, you can download it here

The employer must fill these forms

-

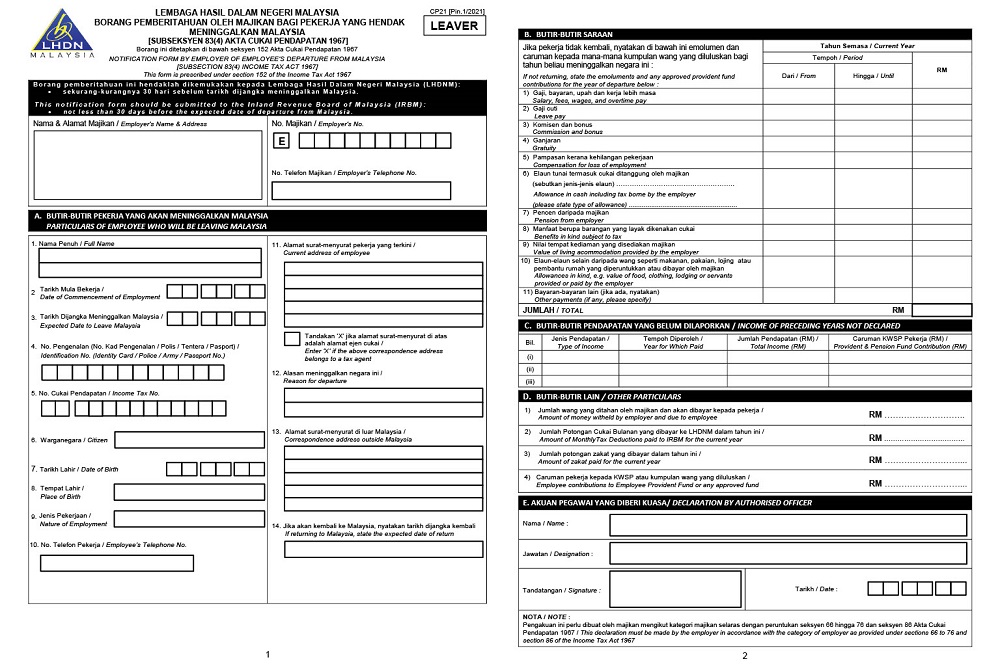

CP21: Notification by Employer of Departure from the Country of an Employee; or

-

CP22A: Tax Clearance Form for Cessation of Employment of Private Sector Employees; and

-

SPC request checklist.

The employer does not need to provide notice of cessation of the employment under these circumstances:

-

Where the employee's income is subject to monthly MTD and deduction has been made by the employer; or

-

Where the employee's monthly wage is below the minimum amount subject to the MTD; and

-

The former employee is to be employed somewhere else in Malaysia.

Form CP22

IRBM's Form CP22 is the Notification of New Employee form. The employer must notify the local IRBM branch within 30 days after the new employee's starting date.

If the employer fails to notify IRBM, they will be prosecuted and liable to an RM200 to RM2,000 fine or imprisonment for six months maximum.

Form CP22A

Not to be confused with CP22, CP22A is a form for the cessation of employment for private-sector employees.

The employer must notify IRBM that the employee is:

- Retiring, or

- Resigning, or

- Leaving Malaysia permanently, or

- Subjected to PCB, and the employer has not made any deduction.

Employers must inform IRBM at least 30 days before the employee's cessation of employment date. They must also withhold money payable to the employee until the employer has received the IRBM Assessment Branch's Clearance Letter.

Form CP22A, you can download it here

The employee's responsibilities

An employee who is about to:

- Cease employment at a company, or

- Retire, or

- Leave Malaysia for more than three months,

must ensure that their prior years' and current year's tax assessment are complete and accurate.

If the employee who is about to cease employment or retire is:

-

Eligible for MTD as a Final Tax: The employee will only need to submit the income tax return for the year of cessation or retirement in the following year to disclose their income accordingly.

-

Ineligible for MTD as a Final Tax: The employee must submit the income tax return for the prior years and the current year of cessation or retirement.

Employer penalty for non-compliance

Employers could face fines from MYR 200 to MYR 20,000 and imprisonment for a maximum of 6 months in addition to becoming liable for the employee's outstanding tax obligations.

Helpful links

LHDN Forms

CP21

CP22A

ezHASiL

Source: IRBM

Articles that might interest you

What Malaysian Employers Need to Do to Hire Expatriates in 2021

HR Guide: The Basics of Form E

Recent Changes to Section 33C of the Industrial Relations Act 1967