Complete Guide to CP Forms: CP21, CP22, CP22A & CP22B

Create Job Description Using AI

Write appealing job descriptions for any job opening to attract the most qualifield and suitable candidates. FOR FREE.

try now

Tax season often brings with it a flurry of paperwork and confusion for companies and HRians.

Among the myriad forms that taxpayers encounter, the CP21, CP22, CP22A, and CP22B stand out as crucial documents in the realm of tax administration.

Understanding these forms is essential for taxpayers navigating the intricate landscape of tax obligations.

Type of CP FORMS

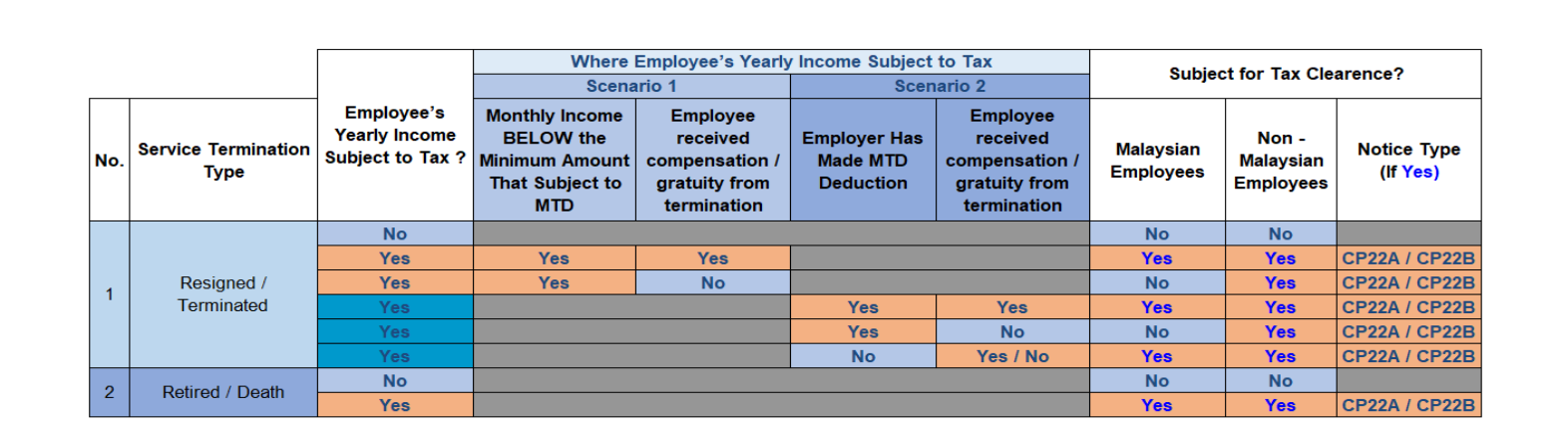

CP22 – Notification Form of New Employee

CP 22A – Tax Clearance Form for Cessation of Employment of Private Sector Employees

CP 22B – Tax Clearance Form for Cessation of Employment of Public Sector Employees

Where the employer is about to cease to employ an employee:

- who is chargeable to tax in respect of income from the employment; or

- is likely to be chargeable to tax in respect of income from the employment; or

- an employee under his employment dies.

The employer is required to furnish Form CP22A / CP22B not less than 30 days before the cessation of employment or not more than 30 days after being informed of death.

- Employers are not required to furnish a form if the employee's income is subject to a Monthly Tax Deduction (MTD) or below the MTD threshold if the employee stays employed in Malaysia.

- Subject to the above exemptions, employers must withhold any payments for employees who have ceased or are about to cease employment and can only disburse such funds with permission from the IRBM after 90 days from the IRBM's receipt of the required form.

The table below is a general guide for employers to determine whether forms CP22A / CP22B notification is required to be submitted:

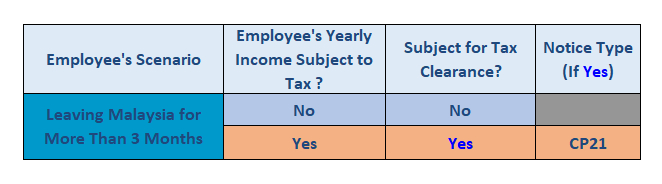

CP21 – Notification Form by Employer of Departure from the Country of an Employee

- Employer is not required to furnish CP21 if the IRBM is satisfied that the employee is required to leave Malaysia at frequent intervals in the course of his employment.

- Employers must withhold any payments for employees who are leaving Malaysia for more than 3 months without intending to return and can only disburse such funds with permission from the IRBM after 90 days from the IRBM's receipt of the required form.

The table below is a general guide for employers to determine whether forms CP21 notification is required to be submitted:

|

Form |

Submission Period |

Method of Submission |

Download Link |

|---|---|---|---|

|

Form CP22 |

Within 30 days from the commencement of employment |

|

|

|

Form CP22A |

Not less than 30 days before the cessation of employment OR not more than 30 days after being notified of death of employee |

|

|

|

Form CP22B |

Not less than 30 days before the cessation of employment OR not more than 30 days after being notified of death of employee |

|

|

|

Form CP21 |

Not less than 30 days before the date employee is expected to leave Malaysia |

|

Download Link |

What if Non-compliance by the employer?

1. Failure to comply with the above provision under subsection 83(2) of ITA 1967 without any reasonable excuse, upon conviction of an offence, will be liable to a fine of not less than RM200 and not more than RM20,000 or to imprisonment for a term not exceeding 6 months or to both.

2. An employer shall be liable to pay the full amount of tax due from his employee. The amount due from the employer shall be a debt due to the goverment and may be recovered by the way of civil proceedings.

Criteria on Incomplete Form which is Unacceptable

- Fill in the Information using an unauthorized method

- Form submitted using an unauthorized method

- Omission to provide information in the form

- Omission to provide employee information in the form

- Omission to provide the amount of remuneration information in the form

- No complete date in the form

- The particulars given in the 'Declaration' section of the form are either incorrectly filled or incomplete.

An incomplete return form which is unacceptable will not be processed and a notification letter will be issued. Delay or failure to submit this form may be convicted of an offence under paragraph 120(1)(c) Income Tax Act 1967.

Read More on Ajobthing :

- Personal Tax Relief 2023

- Employer Branding: What it is? Why is it important?

- How to Create an Effective Employer Branding Strategy

- Probation Period: Things Employers Should Avoid Doing With Probationary Employees

- Probation Period : An Employer's Perspective

AJOBTHING: Your All-in-One Hiring Solution

With AJOBTHING, you get everything you need for hiring in one place. Our HR libraries are packed with helpful resources, and our recruiter advice is personalized to your hiring needs. No more juggling multiple platforms. With AJOBTHING, everything you need is in one convenient place. Join us today and see how we can make hiring simpler and more effective for you.

Urgently seeking candidates to hire?

Look no further! AJobThing offers an effective hiring solution with our instant job ad feature. Hire in just 72 hours! Try Now!