E-filing LHDN Malaysia Guide For Employers (Form E)

Create Job Description Using AI

Write appealing job descriptions for any job opening to attract the most qualifield and suitable candidates. FOR FREE.

try now

If you're managing a company in Malaysia or handling taxes as an HR professional in Malaysia, you probably know tax season is coming soon. That means it's important to remember a few key tasks for the upcoming months. So, we've teamed up with tax experts to highlight four important things for employers and HR managers to focus on as they get ready for the 2023 tax year in 2024.

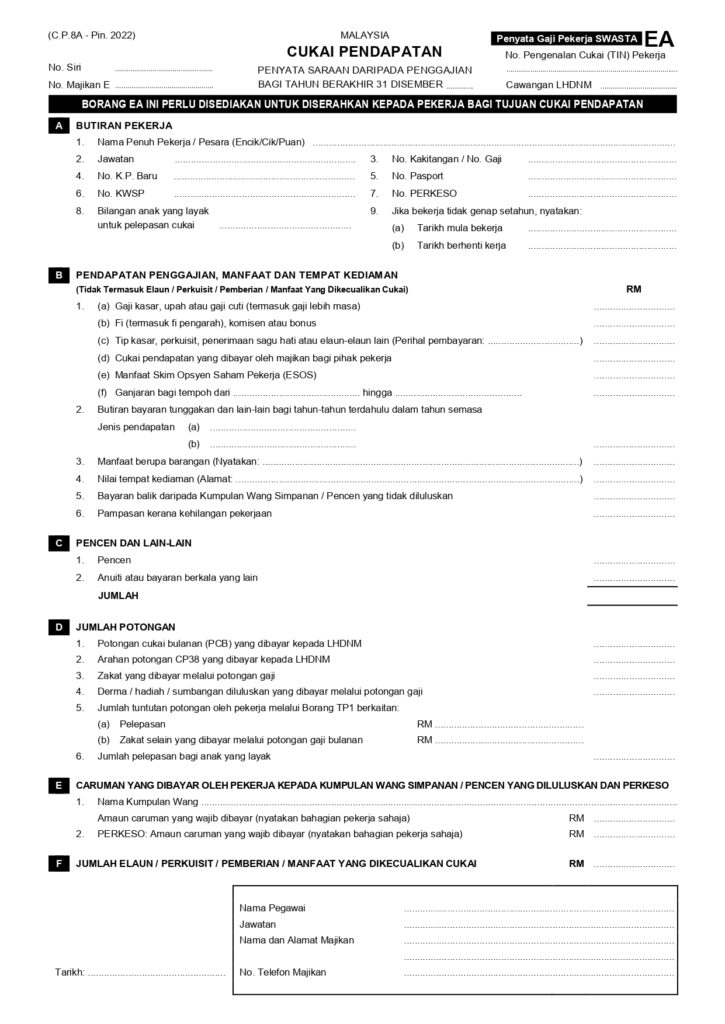

1. Provide EA forms to employees by 29 February 2024

Employers have to provide EA Forms (Borang EA) for employees every year, including 2023/24. The EA Form shows how much employees were paid and other details. All employees should get this form. The EA form should include:

- Gross salary, wages, etc.

- Fees

- Perquisites, gifts, etc.

- Income tax already paid by the employer

- Arrears

- Pensions

- Monthly income tax contributions (MTD/PCB) during the year

- EPF and SOCSO contributions

- And more

As per the Income Tax Act 1967, employers must prepare EA forms for employees by February 29, 2024. Failing to do so may lead to fines ranging from RM200 to RM20,000, a jail term of up to 6 months, or both. For employees, here is guidance of how to fill up e-filing income tax in 2024.

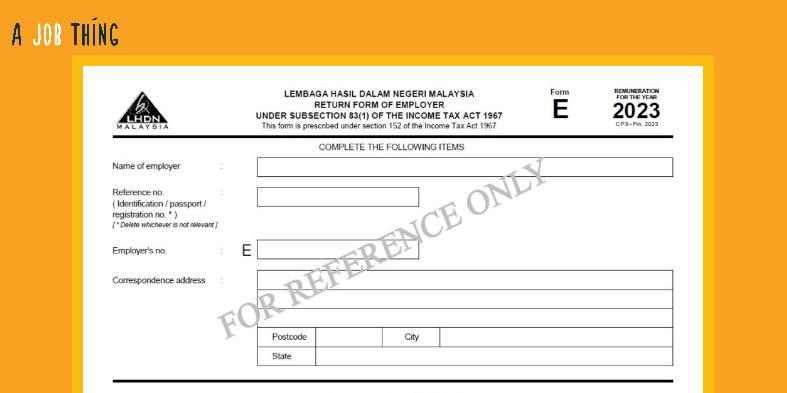

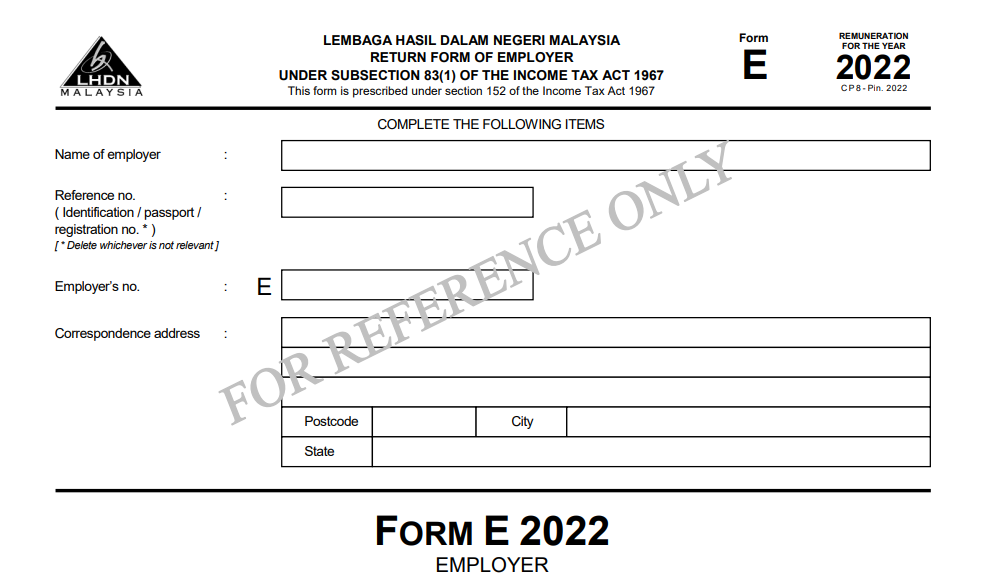

2. Submit Form E to LHDN

Employers must also submit Form E to LHDN by March 31, 2024. The deadline for e-filing is April 30, 2024. Currently, LHDN no longer accepts manual submissions for this form. Form E must now be submitted through LHDN's e-PCB system, including details such as:

- Total number of employees

- Number of employees subject to deductions

- Number of new employees employed

- Number of employees who have resigned

- And additional details

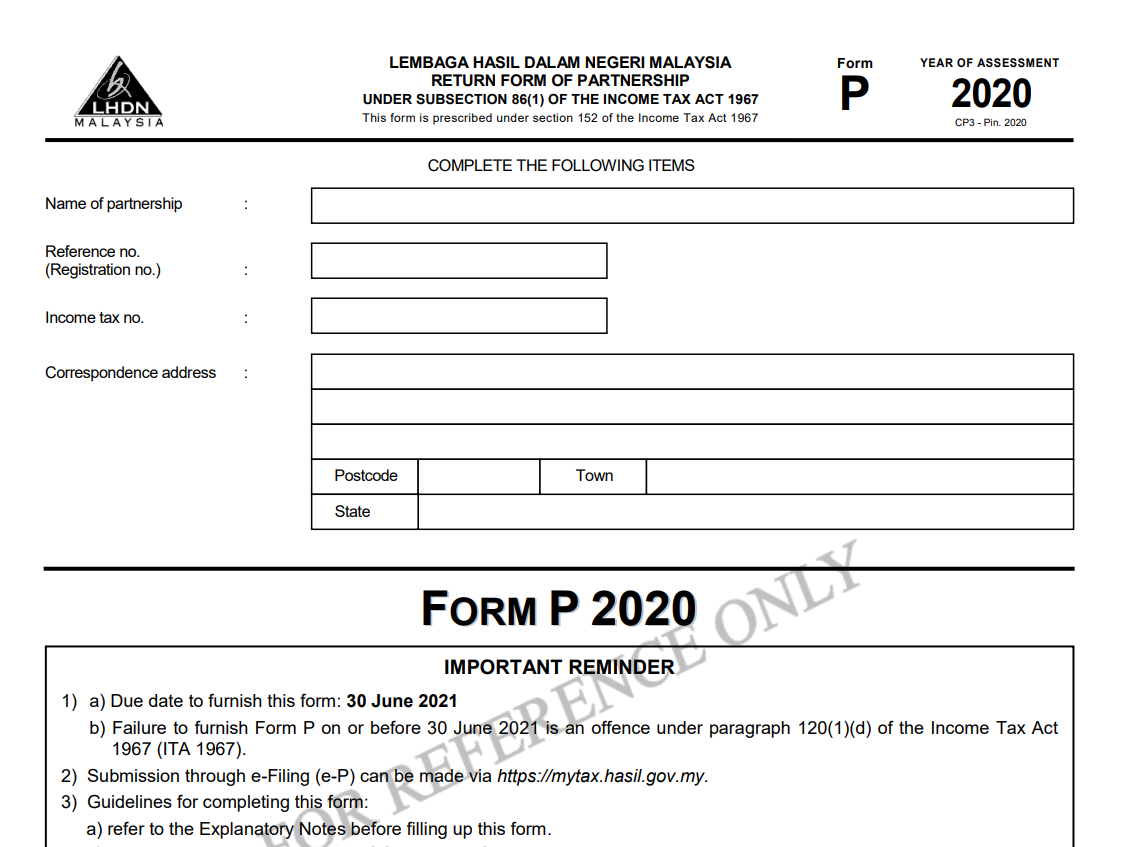

3. Submit Form B or Form E if you operate your own business or partnerships

If you're managing your own business, remember to file Form B (or Form e-B for e-Filing) by June 30, 2024. If you choose e-Filing, you'll have until July 15, 2024, to submit it.

For partnerships, you need to submit Form P for income tax returns to LHDN by June 30, 2024 (or July 15, 2024, for e-Filing).

4. Inform your employees about tax deadlines and requirements

As employers, it's important to convey to your employees the different requirements, details, and deadlines related to tax season in Malaysia. This is especially crucial for those who are new to the workforce.

Urgently seeking candidates to hire?

Look no further! AJobThing offers an effective hiring solution with our instant job ad feature. Hire in just 72 hours! Try Now!

With our recruiter advice guide, you'll make better hiring decisions across various industries.