Here are 12 PENJANA Initiatives for SMEs

Create Job Description Using AI

Write appealing job descriptions for any job opening to attract the most qualifield and suitable candidates. FOR FREE.

try now

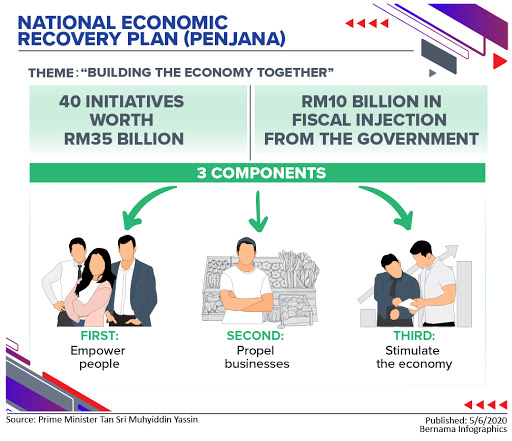

Recently, the Prime Minister announced the National Economic Recovery Plan (PENJANA) which includes numerous initiatives to revive Malaysia's economy. In this article, we will highlight the 12 PENJANA initiatives that were relevant to local startups and SMEs.

These are the ways in which PENJANA can support the local SMEs and startups:

1. Financial Stress Support for Businesses

OBJECTIVE: To ease financial stress on businesses through remissions of penalties related to late tax payments

BENEFICIARIES: All businesses

TIMELINE: Beginning March 2020

Ease financial stress of business through:

-

50% remission of penalty for late payment of sales tax & service tax due and payable from 1st July 2020 to 30th September 2020

-

Extension of special tax deduction for renovation and refurbishment of business premises to 31st December 2021

-

Extension of Accelerated Capital Allowance on eligible capital expenses including ICT equipment to 31st December 2021

-

Extension of special deduction equivalent to 30% reduction in rental for SMEs to 30th September 2020

2. Flexible Work Arrangement Incentives

OBJECTIVE: To encourage work-from-home arrangements by providing support to both employers and employees

BENEFICIARIES: All employees working from home

TIMELINE: Beginning June 2020

To sustain the new normal of work-from-home, the Government will support employers and employees with the following:

-

Further tax deduction for employers which implement Flexible Work Arrangements (FWAs) or undertake enhancement of their existing FWAs (effective 1st July 2020)

-

Individual income tax exemption of up to RM5,000 to employees who receive a handphone, notebook & tablet from their employer (effective 1st July 2020)

-

Special individual income tax relief of up to RM2,500 on the purchase of handphone, notebook & tablet (effective 1st June 2020)

With the increasing number of Malaysians working from home, SOCSO will also provide:

-

Coverage for workers involved in accidents while working at home under the Employment Injury Scheme

Credit: BERNAMA

3. Tax Relief for COVID-19 Related Expenses

OBJECTIVE: To encourage businesses to adapt to new norms and adhere to SOPs through tax relief

BENEFICIARIES: All businesses

TIMELINE: Immediately

Extend the period and expand the scope of expenses allowed as tax deduction or capital allowance for COVID-19’s prevention, including:

-

Covid-19 testing

-

Purchase of PPE and thermal scanners

4. Spur Set-Up of New Businesses

OBJECTIVE: To encourage the establishment of new businesses and transactions such as mergers and acquisitions

BENEFICIARIES: New businesses and SMEs involved in M&A

TIMELINE: Beginning July 2020

To catalyse establishment of new businesses, financial relief will be provided in the form of:

-

Income tax rebate up to RM20,000 per year for 3 years of assessment for newly established SME between 1st July 2020 to 31st December 2021

-

Stamp duty exemption for SMEs on any instruments executed for Mergers and Acquisitions (M&As), for period between 1st July 2020 to 30th June 2021

5. PENJANA SME Financing (PSF)

OBJECTIVE: To assist SMEs adversely impacted by COVID-19 in order to sustain business operations

BENEFICIARIES: Businesses in the critically affected sectors

TIMELINE: Mid June 2020

Additional financing facility to eligible SMEs:

-

The banking sector will offer an additional RM2 billion of funding to assist SMEs adversely impacted by COVID-19 sustain business operations at a concession rate of 3.5%. This financing facility, with an emphasis to finance new SME customers to Banks, will be made available in mid-June 2020 with a maximum loan size of RM500,000 per SME

6. Gig Economy Social Protection and Skilling

OBJECTIVE: To promote the gig economy and provide a social safety net system for the gig economy and informal sector workforce

BENEFICIARIES: 30,000 gig economy employees

TIMELINE: Beginning August 2020

The Government will facilitate policies to support the growth of the gig economy and the welfare of gig economy workers through:

-

A matching grant of up to RM50 million for gig economy platforms who contribute for their gig workers towards PERKESO’s employment injury scheme of up to RM162 and EPF’s i-Saraan contribution of up to RM250 yearly

-

Provide MDEC with RM25 million for the Global Online Workforce (GLOW) program which will train Malaysians to earn income from serving international clients while working online from home

7. PENJANA Microfinancing

OBJECTIVE: To support micro enterprises through funding programmes

BENEFICIARIES: Micro enterprises and SMEs

TIMELINE: Beginning June 2020

Dedicated funding support for micro enterprises via:

-

New funding program for SMEs and micro enterprises at an interest rate of 3.5%

-

Aggregated approved financing will be capped at RM50,000 per enterprise

-

RM50 million is earmarked for women entrepreneurs

8. Bumiputera Relief Financing

OBJECTIVE: To ensure sustainability of Bumiputera entrepreneurs through financial support BENEFICIARIES: Bumiputera businesses

TIMELINE: Beginning June 2020

PUNB will provide RM200 million dedicated financial assistance for Bumiputera owned businesses in the form of:

-

Working capital

-

Operational expenditure

-

System automation

-

Equipment and expenditure to implement social distancing practices (eg. on PPEs)

-

Financing of RM 100,000 – RM 1 million for up to 5 years at 3.5% p.a. interest rate.

-

Moratorium of up to 6 months from disbursement

Through MARA, the Government will also allocate:

-

RM300 million working capital loans to assist affected

Bumiputera entrepreneurs including training colleges

-

Maximum loan amount of RM1 million with 3.5% p.a interest rate

9. Accelerated Payment Terms for GLC and Large Corporates’ Supply Chain

OBJECTIVE: To provide relief cashflow to SMEs who are part of the supply chain of GLCs and large corporates by accelerating payment terms

BENEFICIARIES: Companies in supply chains of selected GLC and large corporates

TIMELINE: Beginning July 2020

To provide relief to SMEs’ cash flows, the Government is encouraging GLCs and large corporations to accelerate their vendors’ payment terms.

Selected GLCs and large companies have already committed to accelerate payment terms to their vendors:

-

Axiata and TM have reduced payment terms for selected vendors from 45 days to

-

14 days

-

TNB has a 7-days payment process

-

PETRONAS launched the Vendor Financing Programme in collaboration with nine banks, to facilitate vendor verification and reduce approval time. In the past few months in particular, PETRONAS has accommodated payment arrangements that have enabled vendors to stay afloat

10. Wage Subsidy Programme

OBJECTIVE: To promote employee retention and reduce layoffs by extending the wage subsidy programme

BENEFICIARIES: 2.7 million workers

TIMELINE: Mid June to end September 2020

The wage subsidy programme will be extended for a further three months with a subsidy of RM600 per employee for all eligible employers

The current wage subsidy program will also be enhanced as follows:

-

Allow employers receiving wage subsidy to implement reduced work week (e.g. 4-day work week with a reduced pay of 20%).

-

Allow employers to receive wage subsidy for employees on unpaid leave, subject to employees receiving the subsidy directly (only applicable for tourism sector and businesses which are prohibited from operating during CMCO)

11. MyAssist SME One Stop Shop

OBJECTIVE: To provide guidance and facilitate the recovery process for Microenterprises and SMEs

BENEFICIARIES: Microenterprises and SMEs

TIMELINE: Beginning June 2020

An online one-stop business advisory platform for the Microenterprises and SMEs will be set up to enhance the outreach of the existing physical SME Hub.

The services offered include guidance for:

-

Funding facility

-

Trade facilitation

-

Branding and promotion

-

Technology support

-

Legal

12. Dana PENJANA Nasional

OBJECTIVE: To support digitalisation of Malaysian businesses by channelling funding from international investors into the local venture capital space

BENEFICIARIES: Start-ups and Local private sector Venture Capital funds

TIMELINE: Beginning July 2020

An investment fund will be established, which will match institutional private capital investment with selected venture capital and early-stage tech fund managers for the following funds:

-

Seed Stage / Co-creation Funds

-

Series A/B Funds

-

Growth Stage Tech Funds

-

Venture Debt Funds

-

Opportunistic Funds (e.g. e-sports, healthcare)

International investors and venture capital funds that have expressed interest include SK Group, Hanwha Asset Management, KB Investment Co. Ltd, Provident Growth, 500 Startups and The Hive

You can read the comprehensive PDF booklet to learn more about all the initiatives under PENJANA. As of now, the exact requirements for an SME or startup to qualify for every initiative is still unclear. However, a few FAQs for certain initiatives including the wage subsidy programme and gig economy programme can be read here.

Hiring Giving You a Headache? You've found the solution! Register at AJobThing.com to access our recruitment services.