What You Need to Know About EPF’s i-Saraan

Create Job Description Using AI

Write appealing job descriptions for any job opening to attract the most qualifield and suitable candidates. FOR FREE.

try now

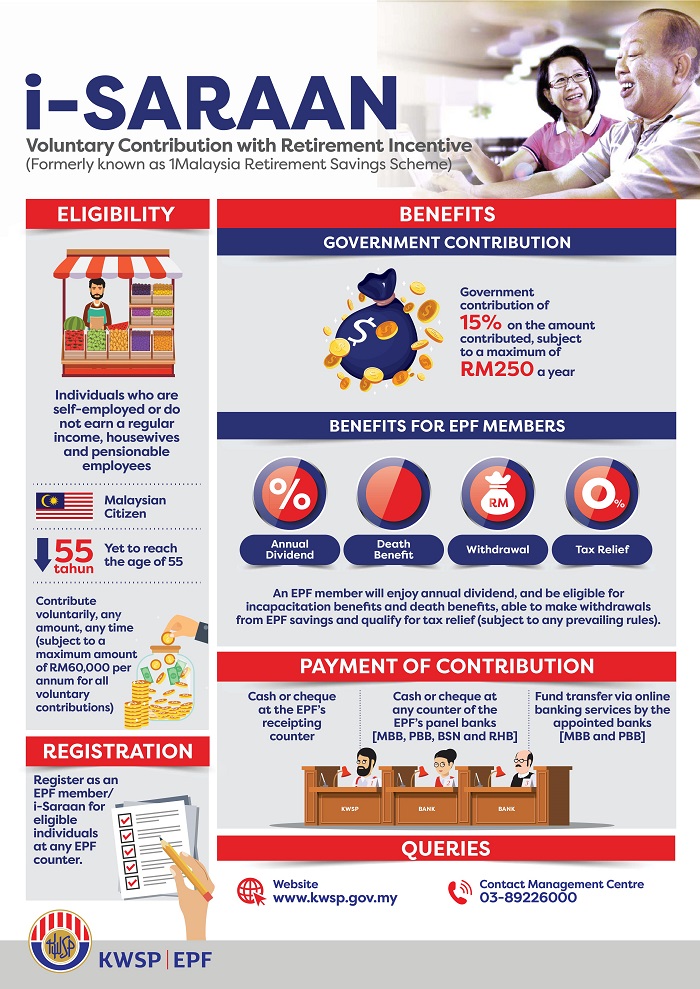

Self-employed individuals with no fixed income are encouraged to contribute through the Employees Provident Fund (EPF) Voluntary Contribution with Retirement Incentive (i-Saraan).

What is i-Saraan?

i-Saraan is a voluntary contribution programme designed to allow workers in the gig economy and the self-employed to save up for their retirement via EPF contributions.

Under this programme, EPF members will receive government incentives of up to 15% of the individual's annual contribution. This incentive is subject to a cap of RM250 per annum.

Under i-Saran, any individual can make EPF contributions at any time, with a maximum of RM60,000 per annum.

i-Saraan strives to encourage self-employed persons and those who do not earn a regular income to contribute to the scheme within their means.

The self-employed category covers:

-

Online Business Owners;

-

Small Business Owners/Hawkers/Night Market Traders;

-

Farmers/Fishermen/Taxi Drivers;

-

Freelancers (those who receive payment for services such as deejays, actors, singers, fitness instructors, consultants);

-

Commission-receiving agents (such as insurance agents and real estate agents);

-

Business Owners (sole proprietors or partners) involved in goods and services trading;

-

Professionals with their own practice (such as accountants, doctors, lawyers);

-

Homemakers;

-

Babysitters;

-

Pensionable Employees.

Benefits of i-Saraan

-

Retirement avenue for self-employed persons or those who do not earn a regular income;

-

Contribute according to the contributor's own time and within their own financial ability and still be able to make withdrawals;

-

Earn an annual EPF dividend on the contributor's retirement savings;

-

Receive an additional special incentive of 15% subject to a maximum of RM250 annually for members aged below 55 years old. The government will provide a special incentive from 2018 until 2022.

-

Death Benefit of RM2,500 * subject to EPF terms and conditions

Eligibility requirements

-

Malaysian Citizen;

-

Self-employed person who derive income from their own work and are not an employee;

-

Registered EPF Member;

-

Below the age of 55;

-

Signed up to contribute under i-Saraan, and submitted Form KWSP 16G(M).

Payment Methods and Channels

Members can make contributions via these methods:

Internet Banking (Online transfer)

-

Alliance Bank

-

Bank Islam

-

Bank Muamalat

-

Cimb Bank

-

Hong Leong Bank

-

MAYBANK (M2u)

-

MBSB Bank

-

PUBLIC BANK

-

RHB Bank

Bank Agent Counters

-

BSN

-

Maybank

-

Public Bank

-

RHB Bank

Registered Bank Agent

EPF Counters

-

Cash (RM500 maximum) or cheque at all EPF counters in the state capitals, including KWSP Muar.

Payment Limit

-

No minimum limit

-

Maximum: RM60,000 yearly for all Voluntary Contribution

What you need to apply for i-Saraan

-

MyKad;

-

i-Saraan Form - KWSP 16G (M) (Only for first time registration);

-

i-Saraan Form - KWSP 6A (2) (during payment);

-

Payment in cash and cheque or via internet banking (form not needed).

How the government credits the contribution to the member's account

The EPF will routinely make government contribution claims based on accumulated contributions for the year's first (January to June) and second (July to December) halves.

After receiving the contribution payment from the government, the amount will be credited into members' Account 1 (Retirement Account).

For further inquiries on i-Saraan, please get in touch with the EPF Relationship Management Center at 03-89226000.

You can also visit i-Saraan's page on the EPF website here.

Articles that might interest you

What You Need to Know About Program Subsidi Upah (PSU) 4.0

Latest Dine-in SOPs for Phase One of the NRP

KPDNHEP Allows Further Relaxation to More Sub-Sectors