A Quick Summary of PERMAI Assistance Package

Create Job Description Using AI

Write appealing job descriptions for any job opening to attract the most qualifield and suitable candidates. FOR FREE.

try now

Yesterday, Prime Minister Tan Sri Muhyiddin Yassin announced a new assistance package.

Called Perlindungan Ekonomi dan Rakyat Malaysia (PERMAI), this assistance package will improve the existing initiatives introduced in the previous assistance packages. Twenty-two initiatives will be implemented under this packaged, anchored on the three main objectives.

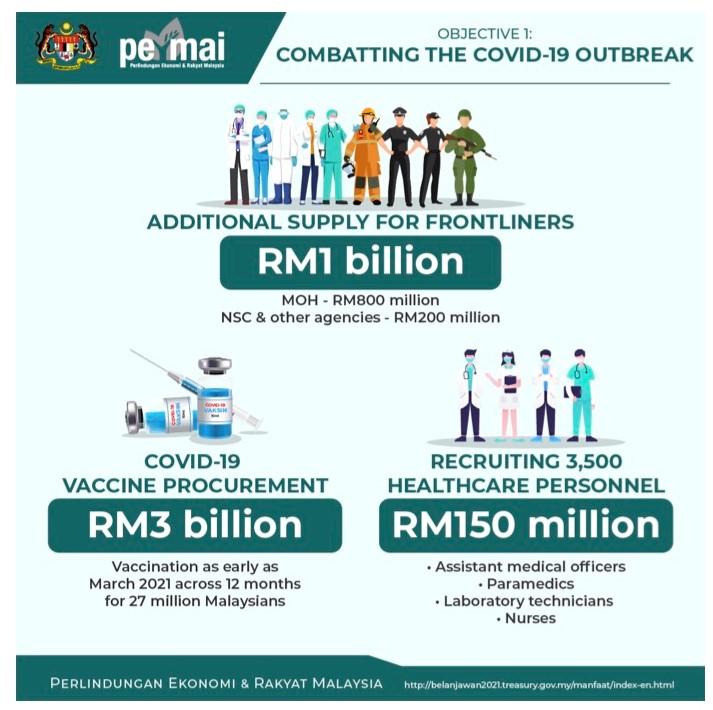

Objective 1: Combating the COVID-19 outbreak

1. Implementing the COVID-19 vaccination programme

The Government has signed three agreements with vaccine producers and is waiting to receive the first batch of vaccines by the end of February. Guidelines and methods of receiving the vaccine will be announced soon.

2. Strengthening the national healthcare sector

The Government will recruit an additional 3,500 healthcare personnel who will start working at the end of January 2020.

3. Enhancing cooperation with private hospitals

Private hospitals have agreed to receive and treat both COVID-19 and non-COVID-19 patients to help ease the strain on the public healthcare system.

4. Stepping up testing of employees

Employers will need to provide suitable accommodation and confine their employees to construction sites. They are advised to tighten the SOPs, improve their foreign workers' accommodation and movement control, and increase employees' screening to curb the spread of COVID-19.

The Social Security Organisation (SOCSO) will bear the COVID-19 Screening Test Programme costs in red zones.

Objective 1 aims to combat the COVID-19 Outbreak. Source: Treasury.gov.my

Objective 2: Safeguarding the Rakyat's welfare

5. Accelerating the Bantuan Prihatin Rakyat Assistance

The last payment of the Bantuan Prihatin Nasional will be brought forth from 21 January 2021 onwards. Families earning up to RM5,000 per month will receive RM300 each, while those who are single and earning up to RM2,000 per month will receive RM150.

6. Strengthening welfare programmes

The Government increased the monthly welfare assistance rate under the Social Welfare Department (JKM). The JKM will also create a Food Basket Programme that will provide essential food items worth RM100 for every eligible family.

7. Continuing the moratorium and loan instalment reduction

Moratorium and reduction of loan repayment instalments assistance will continue during the MCO. The Credit Counselling and Debt Management Agency and Bank Negara Malaysia will assist and advise borrowers via a phone call or online.

8. Enhancing the EPF i-Sinar Programme

Since December 2020, the i-Sinar programme has been made available to EPF members whose incomes have been affected by the pandemic. The EPF will provide an advance of up to RM1,000 from the amount applied under the i-Sinar Category 2 facility. The withdrawal process has also been simplified.

9. Extending the Special Tax Relief on the Purchase of Mobile Phones, Computers and Tablets

A special tax relief of up to RM2,500 on the purchase of mobile phones, computers and tablets will be extended for another year until the end of 2021.

10. Extending the Provision of Free Internet Access

The provision of free 1 Gigabit data has been given to the public to browse websites, including for educational purposes. This facility started on 1 January 2021, and will be continued until the end of April 2021.

11. Extending the sales tax exemption on passenger vehicles

The Government will extend the sales tax exemption for locally assembled and imported passenger vehicles until 30 June 2021.

12. Extending the moratorium period for PTPTN borrowers

PTPTN borrowers affected by the pandemic or floods can apply for a three-month PTPTN loan repayment moratorium. Applications will be closed on 31 March 2021.

Objective 2's purpose is to safeguard the people's welfare. Source: Treasury.gov.my

Objective 3: Supporting business continuity

13. Improving the Wage Subsidy Programme

Under the purview of SOCSO, the Wage Subsidy Programme will be enhanced so that employers working in the MCO states will be qualified to apply, regardless of sector.

For a month, eligible employers will receive a wage subsidy of RM600 for every employee earning less than RM4,000. The wage subsidy limit of 200 workers for every employer will be increased to 500 workers. The conditions for the Employment Insurance System programme has also been relaxed.

14. Continuing the Prihatin Special Grant

The Government will enhance the Prihatin Special Grant Plus assistance to assist 500,000 SMEs in the 7 MCO states with a payment of RM1,000 each. 300,000 SMEs in non-MCO states will receive RM500 each.

15. Providing One-Off Financial Assistance to Taxi and Bus Drivers

The Government will provide a one-off financial assistance of RM500 to 14,000 tourist guides and 118,000 drivers of taxis, tour buses, school buses, rental vehicles and e-hailing vehicles.

16. Accelerating the Implementation of Microcredit Schemes

The Government will expedite the implementation of microcredit schemes that had been announced previously. The implementation of RM1 billion microcredit facilities includes soft loans amounting to RM390 million by Bank Simpanan Nasional, RM350 million by Agrobank and RM295 million by TEKUN.

17. Supporting and boosting online businesses

The Government will speed up the implementation of the SME and Micro SME e-Commerce Campaign and Shop Malaysia Online campaign. Micro-entrepreneurs will receive business coaching and on-boarding onto e-commerce platforms.

18. Enhancing the Danajamin PRIHATIN Guarantee Scheme

The Government announced the Danajamin Guarantee Scheme (SJPD) to encourage the private sector's growth and boost its economy. The Government will:

- Increase the maximum financing to RM1 billion;

- Extend the scope of financing to cover working capital with a guarantee period of up to 10 years; and

- Permit foreign-owned companies operating in Malaysia to obtain the SJPD guarantee as long as Malaysian workers account for at least 75% of their staff.

Objective 3 will support business continuity in these uncertain times. Source: Treasury.gov.my

19. The rescheduling and extension of the moratorium period for MARA loans

MARA PRIHATIN Peace of Mind 2.0 programme will be continued. Borrowers can apply to reschedule the education loan repayment facilities or business loan moratorium until 31 March 2021. Entrepreneurs who are affected by the pandemic, the MCO and the floods can sign up for the MARA business financing rescheduling programme.

MARA will also give out a 30% rental discount on business premises for six months from November 2020 to April 2021. The Government has granted a special tax deduction to any organisation that decreases 30% of the rental rate on business premises for SMEs until 31 March 2021.

The special deduction will be expanded to cover the rental reduction also given to non-SME and continued until 30 June 2021. The Human Resources Development Fund will exempt the employer levy for businesses that cannot operate during the MCO and CMCO periods.

20. The extension of electricity bill discounts

The Government will give a special discount of 10% on electricity bills from January to March 2021 to six business sectors:

- hotel operators,

- theme parks,

- local airline offices,

- convention centres,

- shopping malls,

- travel and tour agencies.

Electricity rebates will be given to each and every TNB user at a rate of two cents per kilowatt-hour, from 1 January to 30 June 2021.

21. Introducing a Bus and Taxi Hire Purchase Rehabilitation Scheme

Under the scheme, a 50% guarantee on financing from hire purchase and leasing firms will be provided for chosen buses such as sightseeing buses, and taxis. Through this scheme, bus and taxi operators can restructure their financing and enjoy a 12-month moratorium and decreased monthly repayments.

22. The extension of the temporary measures for decreasing the impact of COVID-19 act 2020

Last year, the Temporary Measures for Reducing the Impact of COVID-19 Act 2020 was enacted to assist individuals and businesses economically impacted by the COVID-19 outbreak.

The effective period covering inability to perform contractual obligations under the Act was extended to 31 March 2021. It includes hire purchase or lease contracts and credit sales contracts that benefit groups such as the B40, M40 and micro-enterprises unable to meet their contractual obligations.

Source: PMO

NEW and latest Covid-19 SOPs, info and guidelines from the Government >> DOWNLOAD HERE

Articles that might interest you

MCO 2.0: Who Can Go To Work?

State of Emergency: How It Affects Us All

Employers Are Hiding Their Employees' COVID-19 Positive Results

Employers Must Cover Vaccination Costs for Foreign Workers