EPF’s i-Lindung: All You Need to Know

Create Job Description Using AI

Write appealing job descriptions for any job opening to attract the most qualifield and suitable candidates. FOR FREE.

try now

Today, the Employees Provident Fund (EPF) launched its latest platform, the i-Lindung, to facilitate the purchase of takaful and insurance products under the Members Protection Plan.

EPF members can now withdraw funds from Account 2 to purchase insurance and participate in takaful products from the approved Insurance Companies and Takaful Operators.

More about i-Lindung

i-Lindung offers protection which consists of life protection and critical illness.

As of now, the product covers a 1-year term. Members can only purchase these products for themselves and not for their spouses or children.

EPF members do not need to undergo any health or medical assessment before purchasing the products. However, they will need to answer a few health questions provided by the insurance companies.

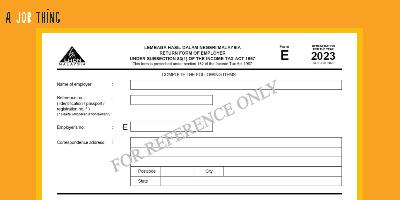

Under the current Malaysian tax regulation, the products offered under i-Lindung are eligible for tax relief.

The i-Lindung self-service platform, available 24 hours a day, allows members to get information on available products and prices and a swift quotation before purchasing the chosen product, anytime and anywhere.

A single view of the purchased policy or certificate will also be offered, enabling members to refer to it quickly and securely.

For extra value, insurance companies and takaful operators on the i-Lindung platform can give additional coverage and tailor the pricing of their products to members' budgets.

FWD Takaful Bhd, Prudential Assurance Malaysia Bhd, Prudential BSN Takaful Bhd, Etiqa Life Insurance Bhd, and Etiqa Family Takaful Bhd are the participating insurance companies and takaful operators.

Requirements to purchase i-Lindung products

Here are the requirements to purchase products under the i-Lindung:

-

Member has enough balance in their Account 2,

-

Malaysian, and

-

An i-Akaun (Member) user.

Members above 55 years old can still purchase i-Lindung products as long as they maintain an RM100 minimum in their EPF Account 55 or Account Emas and within the eligible entry age of the products.

Members can only purchase i-Lindung products online through i-Akaun (Member).

Purchasing via i-Lindung

EPF members can purchase i-Lindung products online by following these steps:

-

Log into i-Akaun (Member),

-

Click the i-Lindung tab,

-

Choose a product offered by the Insurance Companies/Takaful Operators,

-

Fill in the details at the Insurance Companies/Takaful Operators portal,

-

Authorise the deduction from EPF Account, and

-

Receive acknowledgement slip from the Insurance Companies and Takaful Operators.

The coverage will begin on the day the Insurance Company has issued the policy/Takaful Operator. It will send the policy or certificate documents through email. The documents will also be available in the "My Protection Plan" section under i-Lindung.

After a successful application, the payment will not be prompt and may take a few days. The policy status will stay in force unless the payment is declined. If that happens, the Insurance Company/Takaful Operator will cancel the policy purchased.

Members can cancel their policy anytime via the respective Insurance Company/Takaful Operator. If one cancels their policy within 15 days after the coverage starts, they will receive a refund of the premium or contribution paid.

For more info about the i-Lindung, please refer to the EPF's official communication channels through its website at www.kwsp.gov.my, or contact the EPF contact management centre at 03-8922 6000.